Stay One Step Ahead of QM Compliance

Ensure you're QM compliant with our QM Findings Reports.

Accurate.

Transparent.

Retainable.

LoanScoreCard’s exclusive QM Findings Engine, the first viable QM solution on the market, can tell you right now whether your loans are sellable under the new rules.

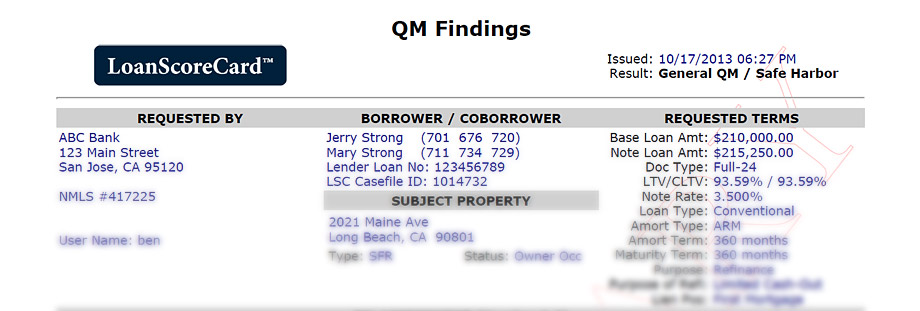

With decisioning based on available loan data and the CFPB’s individual requirements for QM, LoanScoreCard takes the guesswork out of QM compliance with a comprehensive, quantifiable report for the retainable evidence you will need beginning next year.

Why LoanScoreCard...

LoanScoreCard is an automated underwriting engine designed to meet today’s regulatory challenges. We offer easy-to-read Findings Reports that clearly capture how a given loan meets current underwriting and compliance guidelines. You can retain the necessary documentation with your file to support your lending decision in an investor review, regulatory audit or potential claim.

Highlights Include:

- Data is pulled directly from your loan or LOS

- Calculations for Points & Fees, APR, APOR, DTI and qual rate are clearly displayed

- Points & Fees cushion is included in the total analysis

- Each report is a snap shot in time

- Multiple reports can be run for each loan and saved separately for audit purposes

- QM messaging explains and confirms assessment

Sample QM Findings Report