Empower Your Enterprise – Credit Decisions and Fair Lending

Get a competitive advantage with our Custom AUS Engine.

Are you a well-managed bank, credit union or non-agency aggregator looking for a competitive advantage? If you have your own loans programs, you now have access to a totally customizable Automated Underwriting Engine that lets you personalize and brand your credit policy decisions.

LoanScoreCard’s Custom AUS engine makes it easier for you to compete competitively on the financial stage while ensuring safety and soundness in your mortgage operations.

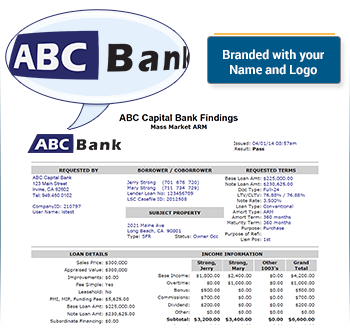

LoanScoreCard provides your originators and underwriters your own unique Findings Report branded with your name and logo, with detailed underwriting analysis in a professional layout, more than what many major financial institutions are able to offer.

Agency AUS engines don’t reflect the underwriting guidelines of your portfolio programs. Manually underwriting every file is prone to human error and fair lending violations. By running your own custom-tailored AUS engine with LoanScoreCard, you are in control of your credit risk profile and documentation requirements.

Accurate.

Transparent.

Retainable.

LoanScoreCard Custom AUS has several features to help you stay competitive like:

- Enforce rules regarding any aspect of the 1003 or credit report

- Outline the documentation requirements specific to the loan at hand

- Establish ‘standard practices’ in manual underwriting, compensating factors and exception approval